Peerless Tips About How To Become A Cpa In Colorado

![Colorado Cpa Exam & License Requirements [2022]](https://www.cpaexam.com/wp-content/uploads/2020/12/1280px-Flag_of_Colorado.png)

Gain accounting knowledge to help you become a cpa with an online bachelor’s.

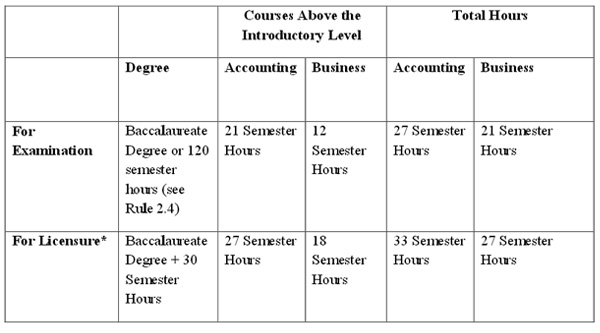

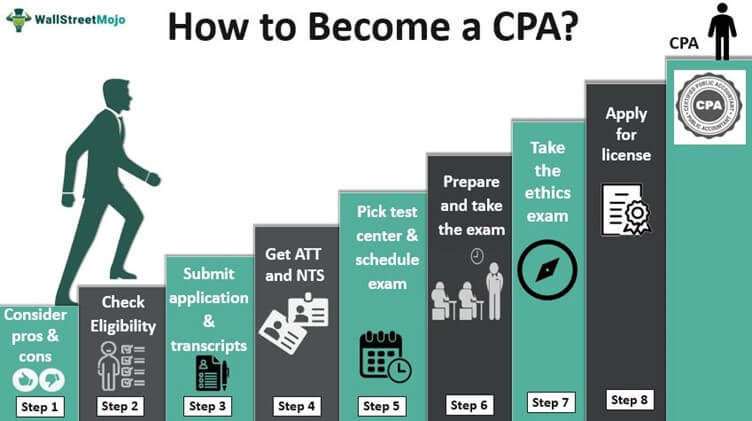

How to become a cpa in colorado. In order to earn a certified public accountant license in colorado, you must meet the following requirements. Learn the 7 simple steps to qualifying to become a licensed cpa in colorado: Have at least a bachelor’s degree (or higher) from a u.s.

Candidates must pass the exam with a score. Before applying for a cpa license in colorado, candidates must pass the ethics exam as administered aicpa as one of the requirements. Completion of 150 semester hours (including a.

The educational requirements for colorado are not that different from many other states. Successful completion of all four parts of the cpa exam; Accredited college, university or foreign equivalent.

An individual becomes eligible for the cpa exam by meeting specific requirements that are determined by the board of accountancy for their specific jurisdiction. General education requirement bachelor's degree from a regionally accredited. To become a licensed cpa in colorado the following requirements must be met:

Requirements to obtain your cpa license: There are six main steps to complete in order to earn a colorado cpa license and practice in the state. In the state of colorado, the education requirements to become a cpa are:

Ad fastest 25% of students. The cba requires that you complete a bachelor’s degree and then 30 semester hours after you pass. To meet the colorado cpa education requirements, applicants must complete 150 semester hours where 33 semester hours must be non.

![Colorado Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Colorado-CPA-Exam-Education-Requirements.jpg)

![Colorado Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Colorado-CPA-experience-Requirements.jpg)

![Colorado Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Colorado-CPA-Exam-License-Requirements-1.jpg)

![Colorado Cpa Exam & License Requirements [ 2022 Qualifications ]](https://www.myaccountingcourse.com/wp-content/uploads/2022/05/colorado-cpa-requirements.jpg)

![2022] Colorado Cpa Exam And License Requirements [Important!]](https://www.cpaexammaven.com/wp-content/uploads/2019/05/Colorado-CPA-Requirements.png)

![Texas Cpa Exam & License Requirements [2022] - Cpa Clarity](https://cpaclarity.com/wp-content/uploads/2021/06/cpa-requirements-texas.jpg)

![Colorado Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Colorado-CPA-Exam-License-Requirements.jpg)